0.66 reasons to bet big on people analytics this year

Lexy Martin and Ian Cook focus their data lens on people analytics to find out how effective it really is.

Why You Should Care

Let your CHRO, CPO, CFO and CEO know that it’s been statistically validated that investment in people analytics pays off.

It's now been mathematically proven, so what are you waiting for?

There is a conundrum at the heart of studying the impact of HR management practices.

Often good practices can be linked to businesses that perform better, but this leads to a chicken and egg problem: Do these practices exist because the business is successful and can afford them? Or do these practices exist before the business becomes successful and help to create its success?

People analytics is one of these practices. It involves collecting and transforming HR data and organizational data into actionable insights that improve people management and the way you do business.

Previously, research has shown that higher performing organizations have more mature and sophisticated people analytics groups—but again, which came first, the people analytics practice or the results?

It’s the chicken: People analytics leads to business success

We now know that the adoption of people analytics drives financial performance! We have the statistical analysis to prove it. The proof comes from the data behind the report, The Age of People Analytics 2021, where we performed a cross-lag analysis on the adoption of analytics topics and financial performance for the same set of companies between 2018 and 2021.

The input variable for the people analytics practice is the range of analytics topics that the organization uses. An analytics topic is an area of business concern such as employee turnover and retention, diversity and inclusion, compensation, talent acquisition, etc. We tracked the adoption and use of 23 different analytics topics in the study.

This is used as it is available for publicly traded companies and is commonly used as a measure of business success that works to compare across industries and across time. It is a measure of how well an organization deploys its resources to generate a profit. The higher the ROA, the more effective the organization is at generating profit from the assets on its balance sheet.

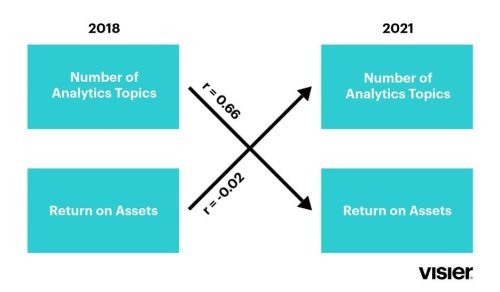

The analysis found a strong positive correlation of r = 0.66 between the increased use of analytics topics and a return on assets.

We looked at this over time to demonstrate organizations that increased the range and depth of people analyses in use achieved the highest ROAs later.

Simply put, increasing the range of people analytics insights that are used to guide business decisions, leads to improved business performance.

The chart below represents this visually.

Fig 1. The higher positive correlation (r = 0.66) between Number of Analytics Topics in 2018 and Return on Assets in 2021 means that an increase in Analytics Topics leads to higher Return on Assets. The very small (negative) correlation (r = -0.02) between Return on Assets in 2018 and Number of Analytics Topics adopted in 2021 means that financials did not drive adoption.

The methodology

In both 2018 and 2021, we ran a survey on the maturity practices of organizations adopting people analytics. The survey questions and population engaged were similar both years, allowing us to look at the impact over time of changes in people analytics practices.

Eight publicly traded organizations, responded in both years and provided a count of the analytics topics in use. The benefit of publicly traded companies is access to common and validated financial results information. Analysis of the eight companies produced a positive correlation of r = 0.66. This indicates strongly that increased use of people analytics topics led to increased financial performance for this group.

We were concerned that while the results from eight companies showed a very strong relationship, this comes from a small sample. To further test our hypothesis and determine whether this relationship could be a one off or fluke, we created a set of 19 pairs of organizations responding in both years, matched on revenue.

The results of that cross-lag analysis showed a less strong, but still significant positive correlation of r = 0.42. This increased our confidence that the results for the eight common companies were not unique to those companies, and that the similar results for the additional 19 companies indicated the relationship between increased people analytics adoption and financial performance is real and enduring.

Using cross-lag analysis to prove financial performance

The approach used in this study, and visualized in the drawing above, is a cross-lag analysis. In its simplest form, a Cross-Lagged Panel Design is calculated by computing the correlation between two variables at two different points in time. The association with the highest correlation implies that variable A at Time 1 is likely causing the change in variable B at Time 2. For our study, this means the variable of analytics topics (AT) adopted in 2018 is likely causing the change in financial performance—higher ROA in 2021.

Furthermore, Figure 1 shows that it is likely the number of analytic topics leading to increased ROA, then the correlation between analytics topics in 2018 and ROA in 2021 should be stronger than the correlation between ROA in 2018 and analytics topics in 2021.

And, if that is not enough, we also found the same directionality using Profit Margin (PM) as an additional financial metric and a component of ROA among the eight repeat survey takers. Adoption of analytics topics leads to increased PM—r = 0.42; whereas, the correlation of PM to adoption of analytics topics was r = -0.17.

However, using one additional financial metric, total revenue, we did not see the same directionality (not unsurprising as most companies’ revenue declined between 2018 and 2021 due to COVID impacts). We thus use ROA and PM as two more stable financial metrics.

Invest in the chicken— it lays golden eggs for your business

Let your CHRO, CPO, CFO and CEO know that it’s been statistically validated that investment in people analytics pays off.

A value chain analysis in our 2021 survey also shows there is a set of analytics topics causally related to improved financial performance. Specifically, adoption of turnover/retention, diversity and inclusion, employee engagement, and total cost of workforce analytics predicts higher financial performance in high-tech and manufacturing firms.

Organizations focused on improvement in these areas retained key talent, improved diversity and inclusion, and maintained and improved employee engagement—all while balancing cost efficiencies related to their total cost of their workforce.

Our 2021 findings also identify a set of practices that go along with adopting people analytics solutions. One of the key characteristics among advanced people analytics adopters is that they provide self-serve analytics to their people managers.

Specifically, organizations are providing analytics to support decisions around compensation and pay equity, in addition to total cost of workforce analytics. With this decision support, managers are doing a much better job of guiding their teams with the confidence of data to support their workforce.

As the data shows, the adoption of people analytics topics drives financial results, making now a great time to implement this practice and take full advantage of its benefits.

+++

Related activity: Watch on demand – The building blocks of success: How The LEGO Group unlocked the power of its people data ecosystem.

Sign up to the UNLEASH Newsletter

Get the Editor’s picks of the week delivered straight to your inbox!

Principal, Research and Customer Value

As head of research at Visier, Lexy explores how organizations achieve value and enable adoption.

VP, Research & Strategy

Ian Cook has spent his 20+ year career building business success through people.