Bye Great Resignation, hello Big Stay?

Find out the views of labor experts.

Why You Should Care

It's been 2 years since the term the Great Resignation was coined.

But is the trend slowing down? Are we entering the Big Stay?

Find out the views of labor experts, both sides of the pond in Europe and the US.

In May 2021, US academic Anthony Klotz declared in a Bloomberg interview that “the Great Resignation is coming”.

However, now, two years later, Klotz believes that quits will begin to plateau; this is partly due to a looming recession, but also, as Klotz told CNBC, “we can’t discount the fact that millions of jobs are better now than they were three years ago, thanks, in large part, to the policy changes companies have made”.

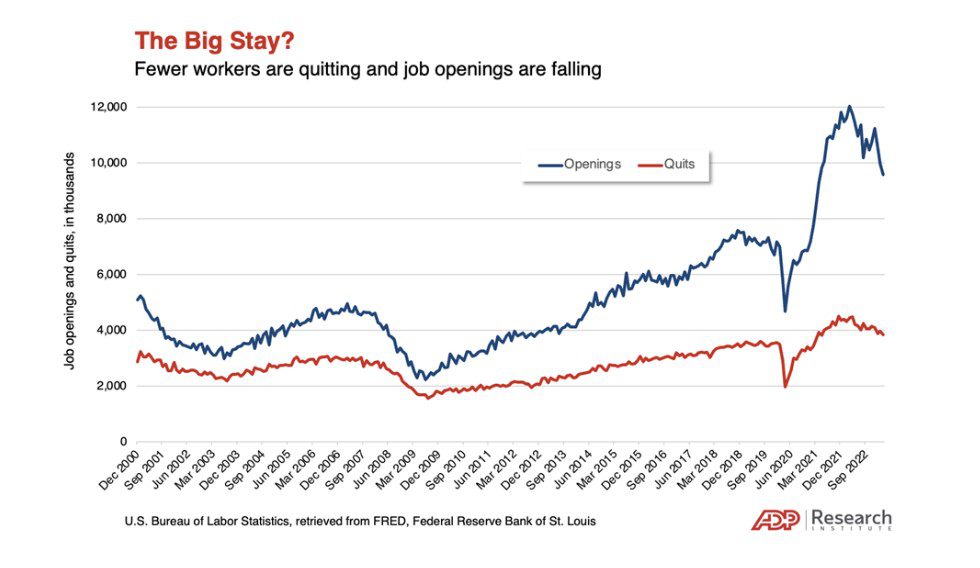

According to ADP’s research, Klotz is to be proved right once again.

In 2022, a record high 50 million American workers resigned from their jobs. But now, the three triggers of the Great Resignation – abundant job opportunities, labor shortages and pay rises for new hires – seem to be “abating”, wrote ADP’s chief economist Nela Richardson in a blog post.

Fewer people are leaving their jobs, and the number of job openings are falling. Plus, people are slowly returning to the labor force since COVID-19 – the labor participation rate is at its highest rate in 25 years, 83.3% – and pay gains for job switches has decelerated from 16.4% in June 2022 to 13.2% in April 2023.

“All the data points to a slowdown in worker turnover as the job and labor markets slow-walk their way back to something approaching pre-pandemic trends. The Big Quit of 2022 could be easing into the Big Stay of 2023”, noted Richardson.

Are we living in the Big Stay?

UNLEASH was keen to find out if other labor economists and HR experts agreed with ADP’s conclusion that we may be on the cusp of saying farewell to the Great Resignation in the US.

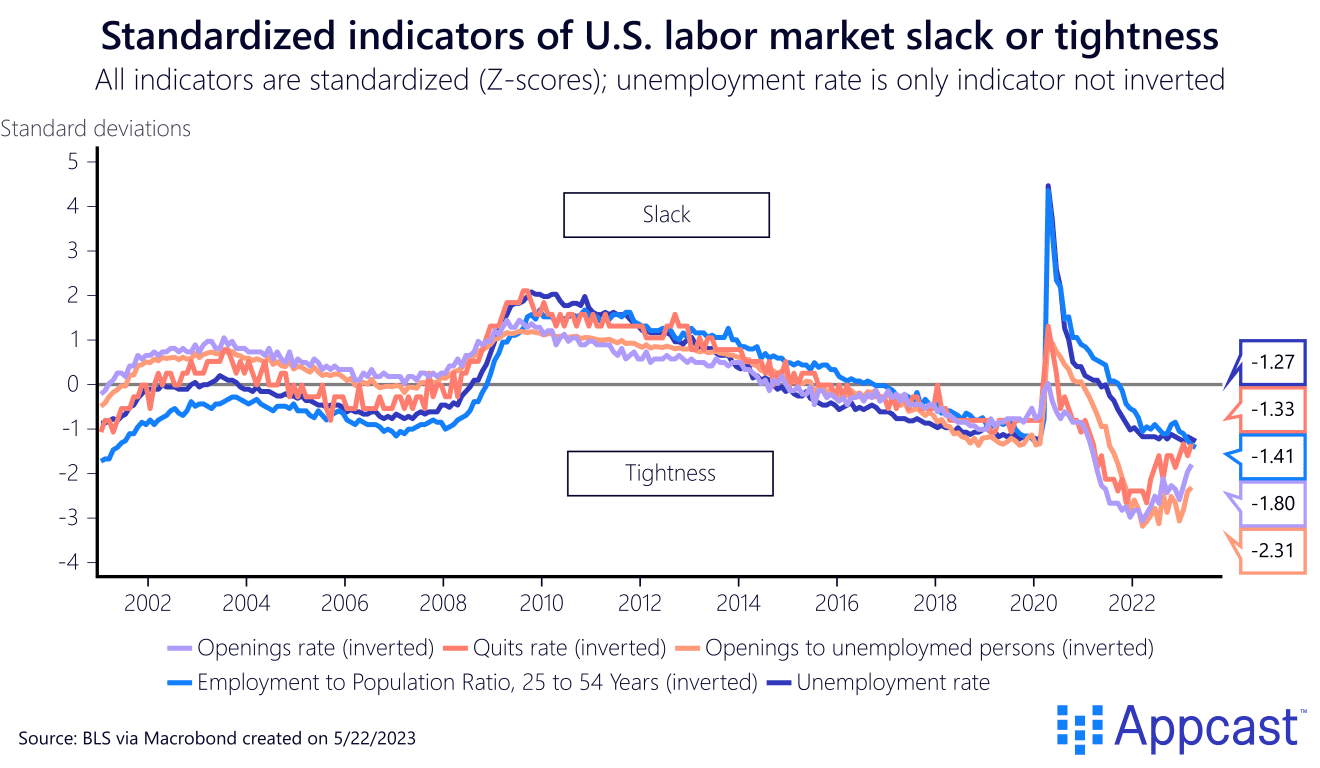

Andrew Flowers, labor economist at Appcast, exclusively tells UNLEASH: “When the labor market is ‘tight’ – that is, when candidates are hard to come by, when demand exceeds supply – workers quit their jobs… because they have better options”.

So, Flowers did some digging, and looked at various labor market tightness factors, including job openings, quits and the unemployment rate.

He found that “even though the quits rate has come down from its historic highs in early 2022, it remains 1.5 standard deviations more ‘tight’ than normal. The story here is that labor demand is cooling – from white hot to red hot. But it’s still a workers’ market.”

Flower concludes: “I do not expect the Big Stay to happen unless there is a deep and dark recession. But, so far, the economy is holding up quite well, and I expect the quit rates to normalize, but not crater”.

It is important to remember that “despite the fear of a recession, job growth remains extremely high, unemployment remains historically low, and wages are rising faster than in past decades”, notes labor expert and senior vice-president of the Institute for Corporate Productivity Jay Jamrog.

Not to mention, as Klotz hinted at, “many companies have doubled down on policies and programs aimed at persuading their high performers and high potential employees not to jump ship”, continues Jamrog.

Protiviti’s director of people advisory and organizational change Kim Lanier also thinks it is premature to talk about the Big Stay. “Everybody loves a great slogan, and it’s tempting to predict that we’ve transitioned from the Great Resignation to the Great Regret to the Big Stay at warp speed.

“However, to label a blip (5% fewer people quitting) a trend is misleading”.

Instead, according to Lanier, “there are some fundamental bigger dynamics at play”. For instance, demographic changes, the birthrate is declining even faster than originally thought and the workforce is retiring earlier than previous generations, and people are embracing self-employment.

This means that “talent scarcity is a concept that is likely here to stay”. The risk of employers embracing this Big Stay narrative is they will dial back on their existing efforts in wellbeing, career development and company culture because they think the job is done – when in reality, according to Lanier, now is the time for companies and HR to “double down” in fighting the war for talent.

“Classifying it as a war should give HR leaders the perspective that it takes a game plan, resources and skill over time to ensure the organization builds and develops the capability it needs to redesign work itself”, adds Lanier.

What’s the situation in Europe?

Of course, ADP’s conclusion about the Big Stay is focused on the US market. But the Great Resignation isn’t isolated to the US, Europe has seen elevated levels of job hopping over the past two years – so this begs the question, is the Big Stay coming to fruition in Europe?

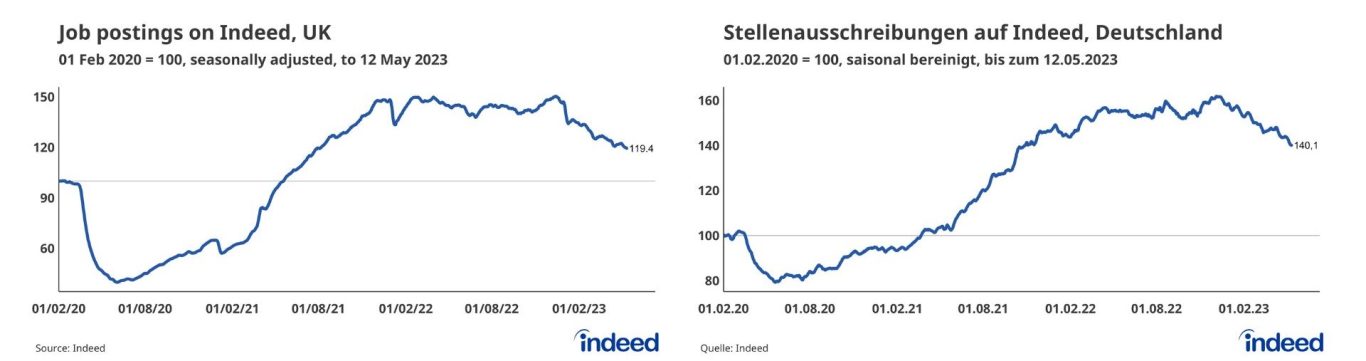

Indeed’s UK & Ireland economist Jack Kennedy notes: “The UK and parts of Europe are seeing a similar trend as found in ADP’s analysis of the US labor market.

“Given the economic pressures facing workers, this doesn’t come as a surprise. We usually see fewer people wanting to risk moving jobs in an economic downturn.”

While the US is facing economic challenges, Europe is more at risk of recession, and has been hit harder by import challenges worsened by the war in Ukraine. So far, the UK and European Union countries have avoided going into recession, but only by a whisker.

Kennedy continues that not only are employees keen to not risk a new job right now, but the “opportunities for them to do so are also less abundant. Though elevated versus per-pandemic, UK job postings on Indeed are the lower they’ve been September 2021” – they’re down 21% from December 2022, the post-pandemic peak. The situation is similar in Germany.

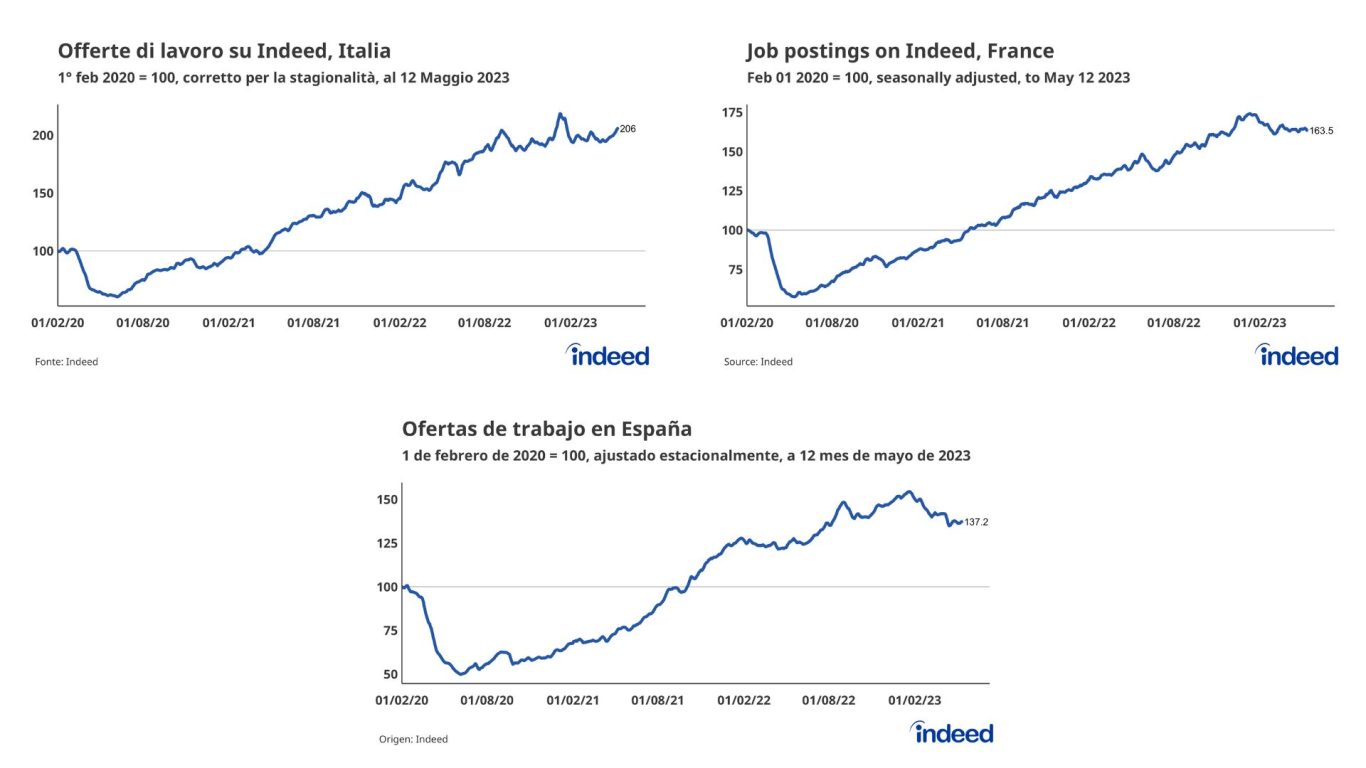

However, trends in the UK and Germany aren’t mirrored across the entire European continent. “Italy has experienced a 6% rise in job postings this year, while postings in France and Spain are beginning to level out but remain far above pre-pandemic levels”.

Therefore, it seems “premature” to talk about a Big Stay trend across Europe as a whole.

It’ll also differ sector to sector, according to Kennedy – according to Indeed data, while some roles, like driving, software development, marketing and accounting are seeing high levels of loyalty, there are other roles (retail, hospitality, manufacturing, sales and customer service) “where workers aren’t as desperate to stay in roles” and have high attrition rates.

LinkedIn data also suggests the Big Stay is a premature label.

While hiring is slowing down globally – the decline is 34% in the UK and Spain, 32% in France, 30% in Italy, 28% in the US and 22% in Germany – employees are still more much likely to leave their current company, than look for an internal move.

Credit: LinkedIn, Global Talent Trends Report, 2023.

LinkedIn’s economic graph data also found that individuals were applying for more and more jobs – the average number of applications per job seeker increased by 17.6% between April 2022 and April 2023 in the UK, Germany, Ireland, the Netherlands, France and Italy. The UK and Germany saw some of the highest year-on-year increases (30.6% and 22.4% respectively).

In this context, LinkedIn’s head of global clients for EMEA and LATAM Becky Schnauffer tells UNLEASH: “Waning employee engagement is proving a challenge for many businesses at the moment, and it is likely that attrition rates will change again in the coming year as hiring fluctuates”.

Like Protiviti’s Lanier, for Schnauffer, the solution is to lean into and double down on retention strategies. “Providing employees with career development opportunities will be vital for businesses looking to improve engagement and retention”.

This approach also has clear business benefits including around “retaining institutional knowledge, creating more connecting businesses”, as well as future-proofing businesses by “building the sills they need from within”, concludes Schnauffer.

Where the HR world meets. Don’t miss out on UNLEASH World in Paris this October.

Sign up to the UNLEASH Newsletter

Get the Editor’s picks of the week delivered straight to your inbox!

Chief Reporter

Allie is an award-winning business journalist and can be reached at alexandra@unleash.ai.