HR tech is ‘mission critical’ to business success: Houlihan Lokey

Two of the investment bank’s managing directors tell UNLEASH why the sector is booming.

Expert Insight

2023 is a boom year for the HR tech space.

What's the sector's secret to success?

UNLEASH sits down with two managing directors from investment bank Houlihan Lokey to dig in.

The global economy is teetering on the edge of a recession – inflation and the cost of living has skyrocketed, some sectors have seen mass layoffs, and the Russian invasion of Ukraine rages on.

Despite these challenging economic circumstances – and investors increasing reluctance to bet on technology – the HR tech market is thriving.

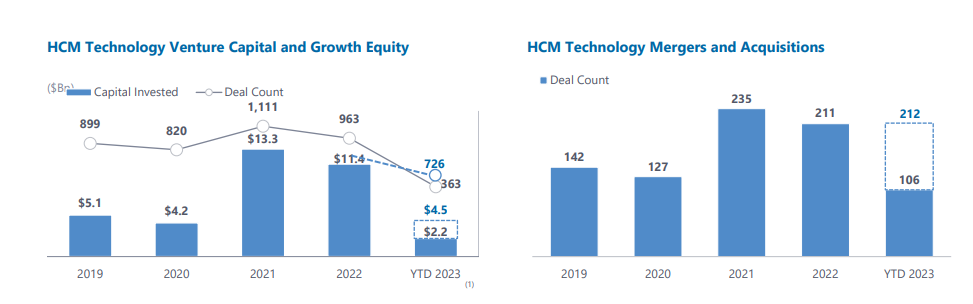

2022 was a booming year for HR tech funding and investment – data from global investment bank and tech M&A advisor Houlihan Lokey found that the total capital invested in HR tech last year was $11.4 billion.

This is confirmed by Drake Star, another global tech investment bank, which settled on a very similar amount for 2022: $11.5 billion.

2023 has carried on the 2022 boom. In the first half of the year, Drake Star recorded a $2.7 billion+ in funding for the HR tech space. Houlihan Lokey counted 363 total deals in 2023 to date – it predicted 726 deals for the whole year.

Credit: Houlihan Lokey’s HCM Tech Market Update, Q2 2023.

For Drake Star, one landmark deal in 2023 was Silver Lake Capital’s take-private of Qualtrics – this led to a $12.5 billion valuation for the experience tech giant. Drake Star also spotlighted workforce management giant’s Rippling’s $500 million Series E round and Allgion’s finalizing its acquisition of Plano.

In an exclusive interview with UNLEASH, Sascha Pfeiffer, managing director and head of European Technology for Houlihan Lokey’s Tech Group, also picks out some standout HR tech investments and deals.

Highlights for him include Zoom buying engagement platform Workvivo, UKG acquiring Immedis to transform it into a multi-country payroll provider and Edenred’s purchase of Reward Gateway for $1.4 billion.

Why is HR tech attracting so much interest?

You’ve seen the facts and figures that HR tech is booming – but this begs the question, why? What is the secret to HR tech’s success?

Pfeiffer’s colleague, Adrian Reed, managing director in Houlihan Lokey’s tech group, notes that HR tech has become “mission critical”.

There is a “recognition of employees as a pivotal resource and the great investment most businesses make, thus leading corporations to invest in innovation [HR] solutions”, continues Reed.

The relationship, and balance of power, between employees and employers is changing – workers have more demands than ever of their employer (and their workplace tech), and this is driving labor shortages in Europe and North America, despite the tricky economic environment.

Adrian Reed, managing director, Houlihan Lokey.

“The increasing ‘war for talent’ is driving the need for anticipatory and flexible talent sourcing solutions, while the global dispersion of talent and mobility of the workforce are further stressing the urgency for robust HR software solutions,” adds Reed.

HR tech companies are aware that to stay competitive, and continue to attract customers and investments, they need to continue to innovate their tools.

A great example of this is how quickly HR vendors have embraced generative AI and sought to find innovative ways to integrate it into their platforms.

Pfeiffer adds that the busy HR tech startup landscape really drives that innovation in the sector.

Small and medium-sized enterprises “continue to play a significant role in the sector as they consistently fuel growth and innovation”.

They are “at the forefront of digital transformation”, and this is why they are attracting VC funding, and are getting snapped by bigger players.

As a result of this success, Houlihan Lokey is predicting that HR tech’s market activity will “persist unabated in the foreseeable future”.

It’s time for payroll to innovate

The success seen in the HR tech market is not just focused in one area – it is spread across multiple sub-sectors, but that spread isn’t even.

Drake Star really spotlighted both talent acquisition and talent management, and Houlihan Lokey’s latest sector report found that payroll is one area that has struggled.

Yes, there was the big UKG-Immedis deal this year, but, by and large, this crucial foundational piece of HR has lagged behind on investment (and also the innovation that is so crucial to that funding success).

Pfeiffer notes that although payroll is “the most important entitlement that an employer provides”, organizations can struggle to get the basics right, so they resort to manual processes.

But this brings human error, and also data and cyber risk challenges.

Sascha Pfeiffer, managing director, head of European technology group, Houlihan Lokey.

Pfeiffer adds that the situation is further complicated by “the ‘war for talent’, global workforce and flexible working are allowing to look beyond geographical boundaries to source the best talent”.

This is “changing how employees are getting paid globally, further stressing the payroll system”.

But employers (and workers) now see that payroll should be “a strategic tool for enhancing employee engagement” – it is a data-rich part of HR that can help drive transparent decision-making, which drives “greater loyalty, trust and productivity”.

So, it is time for payroll vendors to step up and really innovate to become this strategic partner for employers and employees alike.

AI and automation is key here, but Reed warns, “there’s likely to be greater scrutiny on the impact of automation and AI to meet the needs of the evolving workforce trends and security”.

Ultimately, it won’t be easy and “developing new platforms requires a significant capital investment”, but the return on that investment will be huge for vendors, and the future of work in general.

HR tech at UNLEASH World

HR tech is UNLEASH’s bread and butter. Tech, AI and automation will dominate the conversation at UNLEASH World 2023.

It’s not too late to grab your ticket, and hear how YOU can leverage AI to your organization’s advantage from industry stalwarts like Josh Bersin, Anika Grant and Vincent Belliveau!

Sign up to the UNLEASH Newsletter

Get the Editor’s picks of the week delivered straight to your inbox!

Chief Reporter

Allie is an award-winning business journalist and can be reached at alexandra@unleash.ai.