UNLEASH dug into Venero Capital Advisors Q2 HR tech market update – what’s the current and future state of the sector?

The HR tech market remains robust and resilient, according to new data from HR tech M&A advisory firm Venero.

UNLEASH sat down with Venero's Managing Partner Georgios Markakis to dig into the recent Q2 data more.

Here are his insights into the future of HR tech, and specifically the booming AI segment.

“Ten years ago, HR tech used to be the ‘unloved cousin’ of SaaS”, Georgios Markakis, Managing Partner of HR tech M&A advisory firm Venero Capital Advisors tells UNLEASH.

This was “because investors didn’t believe that HR buyers would adopt these, new at the time, SaaS tools” – but “these predictions were proven to be false and the HR tech market has boomed”.

This makes sense as the way people work has changed (and continues to evolve), plus technology is disrupting the world of work, as well as creating opportunities for vendors to address HR teams’ pain points.

Markakis continues: “What is now blatantly obvious is that the HR tech market is not only huge, but it is also extremely resilient, having in the last four years gone through a boom, reset, and now again gradual recovery”.

Venero has just published its 2024 second quarter (Q2) HR tech report. Let’s dig deeper into the state of the sector right now.

One standout finding in Venero’s Q2 market report, according to Markakis, is that mergers and acquisition (M&A) activity remains “extremely robust”.

“Even though valuation levels have been rebased, there are a lot of companies that are coming to market and a lot of buyers that remain highly interested in HR tech”.

There were 100 transactions in the quarter – this is the second highest quarterly volume in almost two years, and up from 93 in the first quarter (Q1).

North America saw the most M&A (47), followed by continental Europe (26) and the UK and Ireland (12). Venero’s report stated that North America’s numbers have recovered after a slow first quarter.

Talking to UNLEASH, Markakis shares that this quarter saw a “very interesting trend” of “US buyers looking to European companies for attractive acquisition and investment opportunities”.

These buyers had previously exclusively focused on the US market, but now they are clearly looking to Europe, and particularly the UK, DACH, Nordics and Benelux.

Some standout M&As for Markakis include the sale of Zellis to Apax – “a huge vote of confidence in the sector by one of the world’s largest private equity firms” and the multiple acquisitions by German HR cloud company Zvoove (it “has been very smart in establishing a powerful vertical sector positioning for itself”).

Other noteworthy acquisitions include Bullhorn buying Textkernel, “which suddenly expands Bullhorn’s target market to also include in-house recruitment teams”, as well as Cornerstone’s purchase of SkyHive that really highlights “the importance of skills, which is here to stay”.

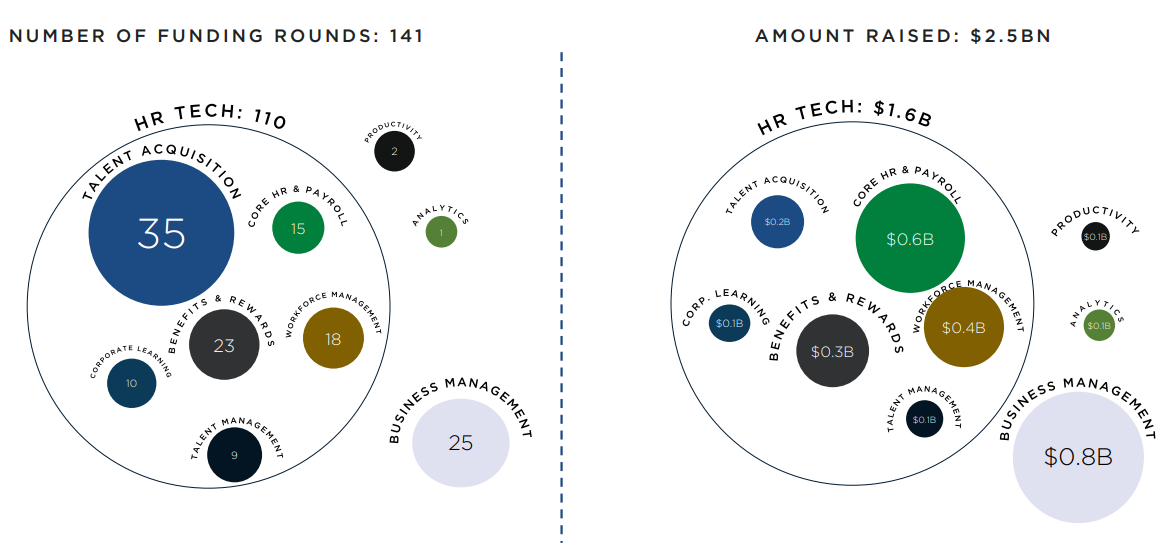

Q2 2024 was more than just about M&A; there were also 141 funding rounds in the quarter – this is in line with figures from the last four quarters.

$2.5 billion was invested across all rounds – this a 32% quarter-on-quarter increase (the figure was $1.7 billion in Q1 2024). There was an uptick in later stage rounds, as well as a larger average investment size of $20.6 million.

The HR segments with the most investment are talent acquisition, benefits and rewards, workforce management and business management. This is largely in line with Q1 data.

Credit: Venero Capital Advisors.

Standout Q2 rounds include $200 million for Rippling, $140 million for SmartHR and $42.8 million for TechWolf .

Markakis tells UNLEASH: “VC sentiment is surely but steadily improving. Every quarter is better than the previous one.”

However, the situation isn’t all rosy; “the screening criteria have tightened compared to 2021, and the bar that companies need to meet in order to secure investment is higher”, plus company growth has slowed in 2023 and 2024.

Venero’s Q2 report also looked into key HR sector trends – it analyzed the state of these sub-segments of HR and picked out some standout vendors.

Unsurprisingly, AI was one of these key sector trends. Venero highlights Eightfold, Crunchr, Phenom and Visier as noteworthy vendors, and talked about how AI is being used in talent acquisition, employee support and data analytics in the HR world.

While there’s lots of optimism and promise for AI, Markakis tells UNLEASH: “Expectations of AI currently exceed the reality.

“But the biggest mistake vendors and HR buyers can make is assume that AI’s capabilities will not improve. AI is here to stay, and it will only get better with time.”

He continues that for vendors, “AI will increasingly become a commodity” – the “key competitive advantage will be the data on which AI will be trained and operated”, not adding a generative AI layer to their products.

For Markakis, this data element of AI “will be a major shift versus the status quo”.

UNLEASH was keen to find out Markakis’ predictions for HR tech over the rest of 2024.

He shares that he expects Q3 and Q4 to “incrementally better” than Q2 – “assuming there are no major macro or political disruptions, we should continue heading towards an environment of lower interest rates and higher optimism!”

Venero report concluded: “Every quarter seems to be better than the previous one, and Q4 could be the strongest we will have seen in two years.”

Get the Editor’s picks of the week delivered straight to your inbox!

Chief Reporter

Allie is an award-winning business journalist and can be reached at alexandra@unleash.ai.

"*" indicates required fields

"*" indicates required fields