VC Voices: HR needs startups to innovate, says Thomas Otter

Check out exclusive HR tech insights from our third ‘VC Voice’, Acadian Ventures general partner Thomas Otter.

Investor Intel

Welcome to the third edition of 'VC Voices', our new Editorial series.

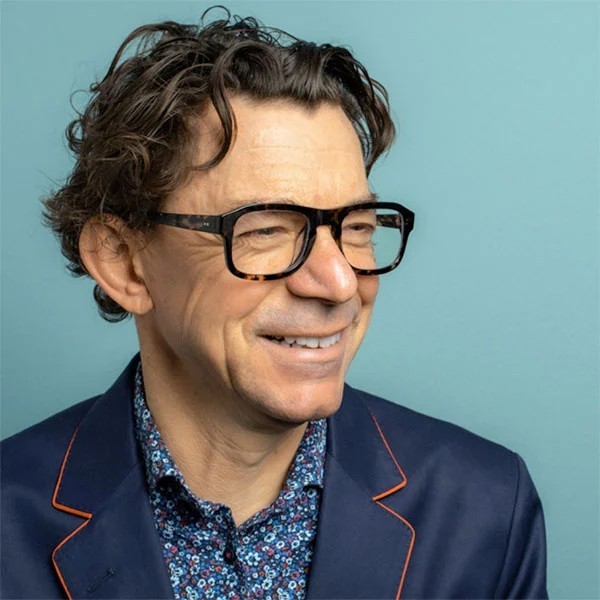

This month, we spoke to Thomas Otter, HR tech guru and Acadian Ventures general partner.

Here's his perspectives on the HR tech landscape, AI, and why HR leaders must work with startups (they won't be able to get all their innovation from incumbent vendors).

HR tech as we know has been around since the 1990s. And one man that has been at the forefront ever since is Thomas Otter.

He started his remarkable career at Gartner, before heading to SAP SuccessFactors; over his five-year tenure at the HR tech giant, he moved up the ranks to become global VP of product management.

Thomas Otter, general partner, Acadian Ventures.

Then in 2018, he left SAP to start his own advisory firm – Otter Advisory’s aim was to help buyers, builders and investors make better HR tech decisions.

As part of this work, Otter started to dabble in investment.

For instance, he acted as a limited partner in fund one of Acadian Ventures, a new specialist fund for the future of work created by another HR tech behemoth, Jason Corsello, former SVP of strategy at Cornerstone.

Otter tells UNLEASH: “I found myself getting more and more involved with the fund operations, so when it came time to set up fund two, Jason I got talking and basically we had the idea to expand Acadian from being a solo general partner, to me joining him as a general partner”.

That was in March 2022, now 18 months on, UNLEASH was keen to find out how Otter is applying his deep, wide-ranging expertise as a HR tech operator and advisor, and applying that to investment.

In this exclusive VC Voice interview, the third in our new Editorial Series, UNLEASH picks Otter’s brain about the current and future state of the world of work.

Plus to find out why he believes startups remain a crucial piece of the puzzle if HR wants to remain innovative.

Allie Nawrat: Let’s start by talking about Acadian Ventures. What type of fund are you? Who are the standout HR tech startups in your portfolio at the moment?

Thomas Otter: We are a specialist fund, focusing on the future work; that’s all we do.

We invest in early stage – primarily seed stage – and we invest anywhere in the world.

Our runaway success in North America has been a company called Nomi Health.

One of the big problems for HR in the US is healthcare; they are taking on some of the biggest healthcare problems in North America.

We were an early investor in Oyster, which is one of the leading players in the remote work space. We’ve invested in Tech Wolf; I’ve known them since they started, and we invested together with Stride.

Then in the learning space, we’ve got the company in the US called Arist.

A couple more to mention would be from France; Figures, and then Compa in the US – both of them are doing interesting stuff in compensation.

Another interesting element of our portfolio is we have a theory that there’s the opportunity to build a strong regional play in the payroll space.

So we’ve invested in four strong regional players – WorkPay Kenya, PalmHR out of Saudia Arabia, Worky in Mexico and BrioHR in Singapore.

AN: Looking back on your impressive career in HR tech, what is one piece of advice you would you give your younger self?

TO: The one piece of advice myself is that you can break through things that you may have been afraid of. It’s actually not that scary.

For a long, long time, I was like, I have a HR and a product background, but I’m not really a finance guy.

But actually, when you say okay, I’m actually going to learn something about finance, it turns out it’s not that hard, you just have to put the time into it.

You learn the jargon; you pick up the principles and you build basic competence – it takes less effort than you’d imagine. It is your preconceptions that have changed.

Always challenge yourself. So, whenever you think, no, I can’t do that, challenge yourself.

Can you really not do that or are you creating some sort of unnecessary boundary for yourself?

AN: What gets you in the morning, and what keeps you up at night?

TO: My biggest fear is boredom.

I like to be learning stuff new all the time; I’ve studied part time most of my life.

The nice thing for me about becoming a VC is though I’ve always been involved in HR tech, I’m learning almost a new profession within HR tech.

It’s a tremendously steep learning curve, and that makes me excited.

As a VC, you are always learning. I speak to several founders a week, and other investors all the time. I am always learning from other people I speak to.

[Recently], I spent a couple of hours talking to an AI guru at Meta, which was fascinating. Learning is an exciting part of my day.

I fear obsolescence.

You want to make sure that the advice and the guidance that you’re giving is based on your latest thinking and latest practice, not on nostalgia – I fear excessive nostalgia.

AN: When you’re talking to startups, and they’re pitching for your investment, what do you look for? What makes a company really stand out in the overcrowded HR tech space?

TO: I ask three very simple questions.

The first question is do you want to build a 100 million ARR (annual recurring revenue) business?

Before I became a venture capitalist, I didn’t really understand – and a lot of people don’t – that venture capital is about finding a small number of companies that will grow very, very big.

It’s not about allocating money evenly across multiple companies, with the hope that they will perform in an average or slightly above average fashion.

Venture is about it’s about finding companies that will go that will give you 100X return. It’s entirely different from picking a stock portfolio.

When you speak to founders, many have the ambition to build a nice business. We’re not in the business of nice businesses, we’re in the business of finding extraordinary businesses. So, the ambition of the founder in the first place [is important].

It is very, very hard to become a 100 million ARR business; very, very few people can do it. I know for a fact, if you don’t want to do it, you won’t.

That’s the first thing, do you genuinely, honestly want to build a really big business?

The second question is what do you believe that other people don’t? You have to have a contrarian theory, a deep conviction, that others would laugh at; that’s where true disruption comes from, and you need that to build something big.

Then the final question is: How can you attract others to that contrarian position – whether that’s co-founders, your first employees, your first investors, and, of course, your first customers?

It is a combination of those three things – but almost always at the stage we invest in, we are investing in those founders and their ambition, their sense of purpose.

We spend a lot of time talking about product evaluation, but really the first gateway is those three topics.

I’ve always said to founders don’t take VC money if you don’t need it.

Come to a VC if you need explosive growth, if you need capital to do something remarkable, and you can’t fund it through other routes.

There’s nothing wrong with not taking VC money.

AN: HR leaders are the key customers of HR tech. How can startups ensure they are really hitting the nail on the head for these essential stakeholders?

TO: The startups that are successful are the ones that have learnt to dance with the elephant: enterprises.

There are some enterprises that are very good at partnering and engaging with startups, others are not so well placed.

What I’d say is as a large enterprise, you will not get all your innovation from your incumbent vendors.

There’s a lot of good value coming from your incumbent vendors if you’re managing them correctly and effectively.

But startups should be an important part of your strategy, and you need to develop a methodology about how you effectively engage with startups.

The expectations you have of startups need to be different from the expectations you have of your incumbent vendors.

My most important advice to enterprise buyers is: You need startups.

You need them to innovate your business practices, but at the same time, you need to be careful that you don’t squash them.

AN: What are the most exciting innovations on the horizon for HR tech?

TO: We’re in an interesting phase with AI.

Everyone’s going to be talking about AI; saying you need AI is a bit like saying you need weather, it is correct, but it is not particularly useful or insightful.

There is a need to go a step further and understand what the opportunities and risks around emerging technology are.

We are in a phase of significant disruption – with regards to AI, there’s a fundamental shift in value from just having good features in products to how it can be used to augment, collate, protect and engage with data.

So, one of the questions I am always asking as an investor, is how are you thinking about data?

Let’s take the example of Figures in our portfolio. Figures started off by saying, I want to collect the best compensation data in the markets I am operating in – the most in-depth, accurate compensation data.

They did that through partnerships with vendors, customers, and so on – that was very robust data curation and data aggregation capability. Then after that, you can then build functionality, a new product, on top of that.

Whereas 20 years ago, you would build the functionality first, and then you would hope that that application would collect the data.

AN: Name an individual who inspires you, and why?

TO: One of the people that inspires and fascinates me is a guy called Joseph Weizenbaum. He’s one of the founding figures of AI and computer science – he developed the first chatbot.

What’s super impressive about his work is that Weizenbaum was one of the first people who really thought about the risks and the ethical dimensions of computers in society.

To me, that’s quite profound and makes me always think [yes,] there’s a bright side to technology, but there’s also a dark side to technology.

One part of our job [as VCs] is to try and invest in technologies that augment the bright side and help mitigate the dark side.

As investors we need to focus capital on things that we think will be good for society.

Weizenbaum, for me, was the guy who really articulated this most profoundly and cleverly as the technology was emerging.

So, he’s always in the back of my mind when I think about technology.

UNLEASH | VC Voices is a monthly Editorial interview series where we profile leading investors in the HR tech and future of work space. You can catch up on September’s VC Voice here, and stay tuned to see who next month’s voice will be!

Startups at UNLEASH World

Startups are a core part of the UNLEASH ecosystem. Alumni winners of our prestigious startup competitions include Peakon (now part of Workday), OneTeam, Talent Alpha and Hour One.

UNLEASH is thrilled to announce that Thomas Otter will be on the judging panel for the UNLEASH World 2023 Startup Award. Want to join him at the Paris show? It’s not too late to grab your ticket!

Sign up to the UNLEASH Newsletter

Get the Editor’s picks of the week delivered straight to your inbox!

Chief Reporter

Allie is an award-winning business journalist and can be reached at alexandra@unleash.ai.

-

Topics

Emerging Tech

HR Technology