The ROI from financial wellbeing is clear

In nudge’s Global Financial Wellbeing Report 2023.

Why You Should Care

The global economic outlook is not good.

Employees are struggling, and they need more support.

Find out about the gold standard of financial wellbeing benefits.

HR leaders, don’t miss out: Join us in Las Vegas for free as a VIP guest at UNLEASH America.

Economies across the world are grappling with sky rocketing inflation – it has reached 40-year high in the US, as well as parts of Europe and Asia-Pacific.

As a result of the cost of living, employees are becoming more and more worried about their finances.

Research by nudge found that 44% of employees are anxious about their financial situation – this anxiety increases to 55% in the UK and 51% in the US.

This is impacting their productivity – how can people do focused work when they are distracted and worried about their financial situation – and, therefore, business bottom lines.

HR leaders are aware of the situation (95%), and they want to do something to change it. 89% told nudge that improving financial wellbeing was a top priority in 2023.

This is good news, but the question that remains is where should they start?

No one-size-fits-all

According to nudge’s survey of 3,000 workers globally, financial education is the key to success.

HR is aware of the importance of financial education, but it is not taking the right action.

nudge co-founder Jeremy Beament tells UNLEASH: “Perhaps the most surprising finding [of the Global Financial Wellbeing Report 2023] is the lack of prioritization of financial education amid this global financial crisis.

“82% of HR and benefits leaders agree education is very important to financial wellbeing strategies, only 20% currently offer educational resources.”

Beament adds: “And even more surprising is that employees continue to ask for financial education benefits and tools.

“Between 2022 and 2023 the number of employees asking for financial education as a benefit rose dramatically, from 26% to 42%.”

But employers cannot offer any old financial education – formal approaches haven’t been working – instead employees need accessible, personalized and frequent financial education.

If employers can succeed around financial education, 43% of workers are more likely to be committed to their employer. 51% said financial wellbeing provisions in general would drive employee loyalty – this proves the return on investment (ROI) on financial wellbeing.

Beament concludes: “Our research provides HR leaders with the business case that proves the positive impact of financial education on business.

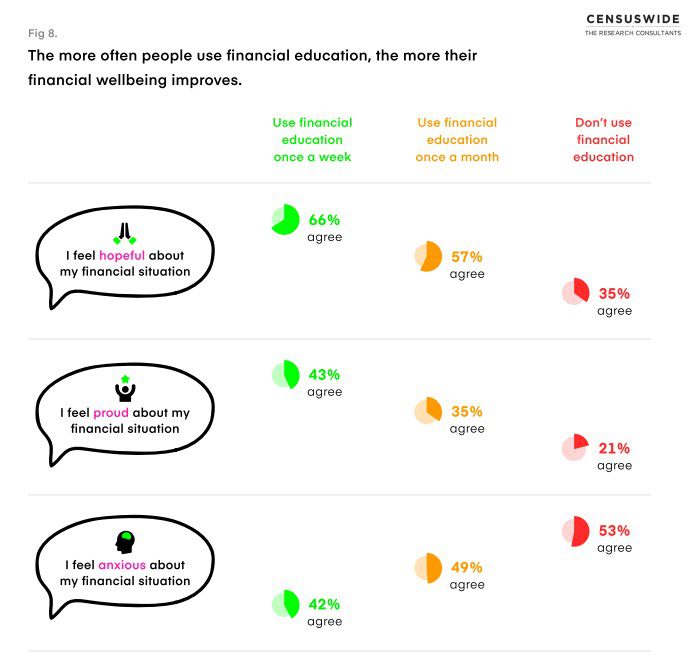

“The global study reveals that employees in financial wellbeing programs are 81% less likely to feel overwhelmed by debt and 66% more hopeful about their finances.

“And employees who receive financial education have a 34% stronger understanding of their employee benefits and 41% have increased their retirement savings.

“With so many people concerned about their finances and the state of the global economy, employers need to act now on financial education.”

Ultimately, financial education is not a nice-to-have, it is a must-have benefit.

The International Festival of HR is back! Discover amazing speakers from the world of HR and business at UNLEASH America on 26-27 April 2023.

Sign up to the UNLEASH Newsletter

Get the Editor’s picks of the week delivered straight to your inbox!

Chief Reporter, UNLEASH

Allie is an award-winning business journalist and can be reached at alexandra@unleash.ai.

Contact Us

"*" indicates required fields

Partner with UNLEASH

"*" indicates required fields